I recently had the pleasure of speaking to Tom Coward, CFO of Cytora, named by Sage as one of their 2021 Finance Futurists.

The Finance Futurists represent a new approach to financial management, moving from purely numbers and analysis towards emotional intelligence and communication. In today’s business world, in which, for many sectors, remote working has become the norm and digital innovation a critical success factor, this future-thinking approach is a developing trait of successful CFOs.

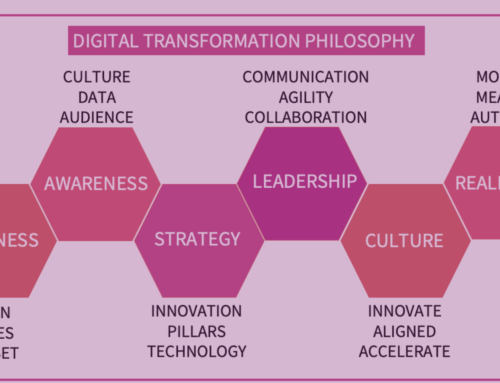

Here, I share with you some of the key things which you should be thinking about in your digital leadership role.

- Financial leaders are responsible for shaping culture

Traditionally, the finance role in a business has often been just that. About the numbers. Sometimes recruitment and HR have been rolled in with it, sometimes not. Whatever the structure, these are areas that are often seen as support functions – necessary to the operation of the business, but hardly at the leading edge of innovation and culture. Great CFOs understand that these functions drive the business, though: Finance, through setting the objectives, and HR/Recruitment through ensuring the right people are in place to create the culture you need.

It’s crucial to have the right people on board, especially when you’re looking for rapid growth and scaling. Hiring and on-boarding people is expensive, and you need to be sure you’re getting people with the attitude and aptitude that supports your aims. Skills, on the other hand, may be less important. You can teach skills, but an attitude is much harder to shift.

One of Tom’s tips here was about referrals. If you’ve got great people on the team who recommend other great people, half the job is done for you, as they are already ‘pre-vetted’. So you can save yourself a lot of time (and recruitment costs) by recruiting through referrals from your existing team.

If you’re coming in to a readymade team, you need to seek out the ‘firestarters’, those people who are passionate about the organisation and who might help you. They are the ones challenging everything; who understand other people’s motivations, and you need to keep them around.

You might also find great people, but who are in the wrong role. That’s quite common in a fast-growing company that’s changing a lot. Maybe what they’ve been working on for the last 6 months isn’t priority anymore, so you need to recognise them, understand them and move them to where they’re going to make an impact.

- Get it done vs get it perfect.

If you’re in the driving seat of scaling a business, you’ll be keen to avoid mistakes (in any area, not just in hiring), and get everything right. Firstly, it’s important to acknowledge that there probably isn’t a single successful leader who would claim that they could look back and say that they made no mistakes along the way.

Even more important to recognise, though, is something we’ve all learned over the last 12 months. Sometimes, you just need to get it done.

Responding to major disruptions like Covid, or even a change, new development or setback in your particular sector is sometimes about speed. As a future-thinking finance leader, you need to be at the heart of driving that agile culture.

Something to think about here is your own leadership style. Do you actively encourage and reward ideas and innovation across the business? I’ve written some more detailed insights into leaderships styles for digital leaders.

- Make your customer focus a sticking point

Tom told me about an early experience with an product that wasn’t quite ‘sticky’ enough. What he meant by that was that he was working with a product that got a bit lost in the middle ground of their market – not quite a top-end provider, and not quite different enough from cheaper ‘DIY’ options. So they’d lose clients after 6-12 months as they traded up, or down.

Future-thinking means looking at what will keep your customers loyal to you – which means developing a deep understanding of their needs and wants, anticipating how these may change, and engaging in a constant round of innovation in order to keep ahead of the competition.

- Share your vision

To maintain the engagement and motivation across your company, you need to create a culture where everyone buys-in to your company vision. You need to link everything you do to that vision.

If you’re opening a new office in a particular area, for example, people need to know why? How does that new office (especially in this age of remote working) connect with the vision. Perhaps it’s in support of establishing your dominance in that area. If that’s the case, people need to know.

Making sure people are informed and aware means a constant responsibility for you to communicate, and communicate effectively. When they understand the vision, people will see where they fit in, and be more engaged.

- Recognise individual preferences

You need to be an intelligent communicator, who recognises that people consume information in different ways. Some need to talk things through, while others prefer long form documents. If you have a remote team, how, when and where you share information and invite discussion becomes even more important.

- Seek out your peer group

Tom talked a bit about peer networking and how helpful it is – especially when it comes to tackling ‘impostor syndrome’. Sharing ideas and experience will help you to navigate growth and change, and hopefully to avoid some of those mistakes we talked about earlier.

- To drive it, get to know it.

When you join a company you may need to spend a fair amount of time understanding where it’s at right now – talking to stakeholders and asking the tough questions.

Tom and I agreed that the difference between being a good CFO and a great CFO is the ability to understand the culture and work with that. 30% of that is understanding the culture as it is now, and 70% is working out what it needs to be. To do that you have to really get to know the organisation, understand the way it works and how the team execute the vision and challenge each other.

Remember, though, that whilst you might spend up to a year or even two getting under the skin of a new company, it can, and will, change dramatically in that period of time.

You can read my full interview with Tom Coward here.

Ready to produce game-changing digital results in your business?

Subscribe to receive cutting edge insights on digital leadership and transformation- straight to your inbox

We do not sell or share your information with anyone.